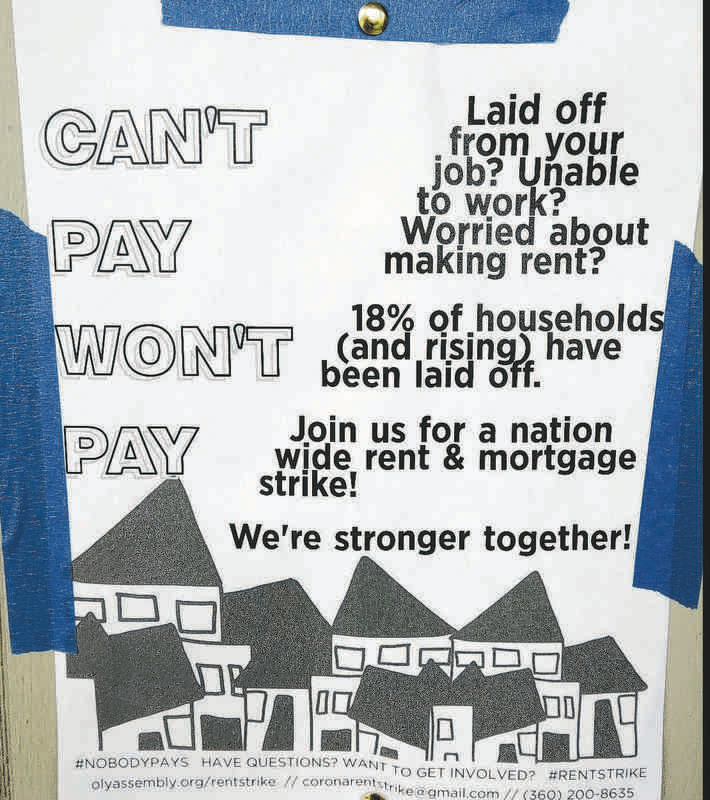

An example of rent strike posters that have popped up around the Olympia area

BY ROLF BOONE (4-26-20) 360-754-5403, @ROLF_BOONE

RBOONE@THEOLYMPIAN.COM

Olympia, WA — Thurston County property managers say most tenants paid their rent on April 1, the date falling only a couple of weeks after the governor ordered schools and businesses to close to combat the novel coronavirus.

But May 1 is likely to look a lot different, they say.

The economy has been further slowed by the virus, jobless claims have soared, and although jobless benefits have been enhanced and stimulus checks are arriving, average rents in the county still hover around $1,200 — the amount of the largest stimulus checks.

Some local tenants are calling for a rent strike, wanting to call attention to the economic burden placed on renters during the pandemic.

“It’s looking a lot worse,” said Andrew Barkis, a Republican state Representative and the longtime owner of Olympia-based Hometown Property Management, a business that manages 1,100 single-family residences in the county for an array of owners and their renters.

About 90 percent of tenants paid their rent on April 1, but come May 1, Barkis expects that to fall to 60 percent to 70 percent.

“People are going to have a tougher time,” he said, adding that he hopes tenants are receiving jobless benefits and a stimulus check. “There’s a lot of uncertainty.”

HOMES FIRST

That uncertainty extends to the nonprofit sector as well, such as Lacey-based Homes First, a provider and property manager of affordable housing in the area. It works with 277 tenants spread among 46 properties.

Chief Executive Trudy Soucoup said all but two tenants paid their rent on April 1, but come May 1, she expects rental income to drop as much as

20 percent.

She said those who can’t pay rent will not face any consequences, but she does expect tenants to eventually pay, or to seek assistance to pay rent.

“We will continue to do the things we do,” she said, which includes helping tenants with food and child care, “but tenants need to do the things they need to do.”

Rental income helps the nonprofit carry on with its mission, she said. Faced with a drop in income, the nonprofit lined up for a federal loan through the Small Business Administration called the “paycheck protection program.”

Homes First secured a $95,100 loan through the program, which converts to a grant if 75 percent of the money is used for payroll over the next eight weeks. That’s the plan to retain eight staff members, she said.

That money will help the nonprofit through the end of October. However, they also need to continue to raise funds through donations, and that has become more challenging, she said.

‘THERE HAS TO BE A BALANCE’

A small business like Hometown Property Management could seek a loan as well, but Barkis is not aware of a program to specifically help landlords themselves. He also was disappointed in Gov. Jay Inslee’s recent extension of an eviction moratorium through June 4.

“People have lost their livelihoods through no fault of their own and we must continue to take steps to ensure they don’t also lose the roofs over their heads,” Inslee said in a written statement at the time.

Under the latest moratorium, landlords are not able to raise rents or charge late fees, Barkis said.

Barkis isn’t seeking to add to the hardships of tenants, he said. He has worked with them on payment plans, breaking up rent payments and extending time frames, but, he asks, what about help for landlords? Many of them have to pay mortgages on their rental properties.

“There has to be a balance,” he said.

Some of the home owners that Hometown Property Management works with are investors, some are home owners who held onto their first home to rent, and some are members of the military who have been transferred out of the area but who want to return at a later date. In the meantime, they are working with Hometown to rent their property, he said.

There is a state landlord mitigation program, in which landlords can tap funds for certain rental situations, but in its current configuration he doesn’t think it could be used during the crisis.

Or could it? “There is a program and a framework for the crisis,” he said.

TENANTS STRIKE BACK

Meanwhile, Brian Wolcott, a student at The Evergreen State College is on strike — rent strike, that is.

He rents a house with three other roommates for about $1,500 a month. Rent wasn’t paid in April, and likely won’t be paid in May, but he said they are in contact with the property owner about their decision.

For Wolcott, it’s both political and practical: he wants to stand in solidarity with those who can’t pay rent, but work — such as the farm work, yard work and other odd jobs that he used to do — also has dried up.

Wolcott also acknowledged that he could probably find work, but then he wonders if he has his priorities straight, especially if he’s out interacting with people, possibly exposing others to the virus or being exposed himself. Rather than being guided by economic decisions, he’d rather follow the guidelines of health care professionals and scientists.

The economic burden placed on renters needs to be pushed up the ladder, he said.

“Financial institutions have the ability to weather this stuff, but it’s a real push for everyday people,” Wolcott said.